The leading Dedicated

Managed Account Platform globally

The investment industry is undergoing a massive transformation. Institutional allocators are now choosing DMAs to access their alternative investments.

We are transforming the way institutional allocators access their alternative investments.

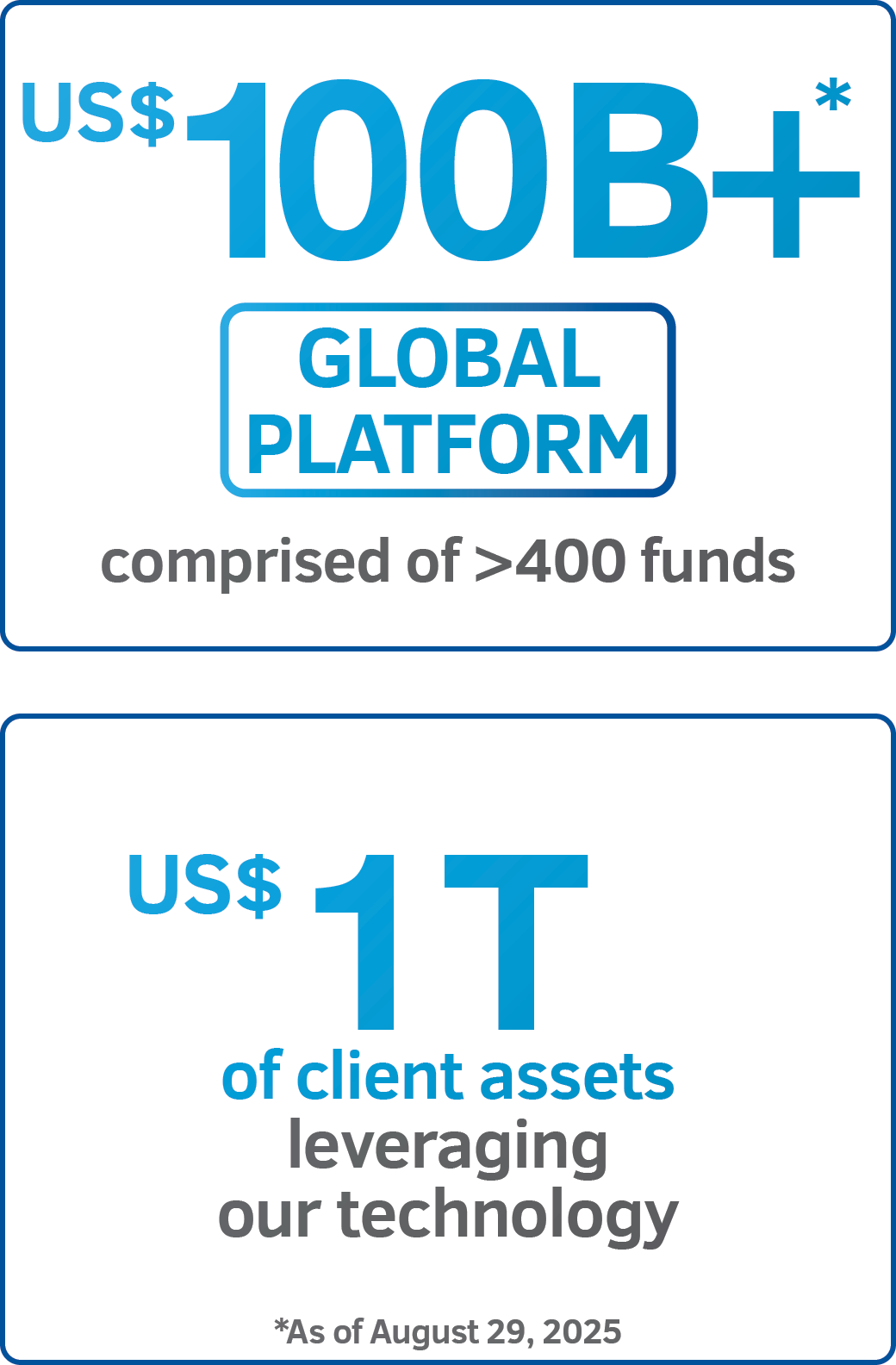

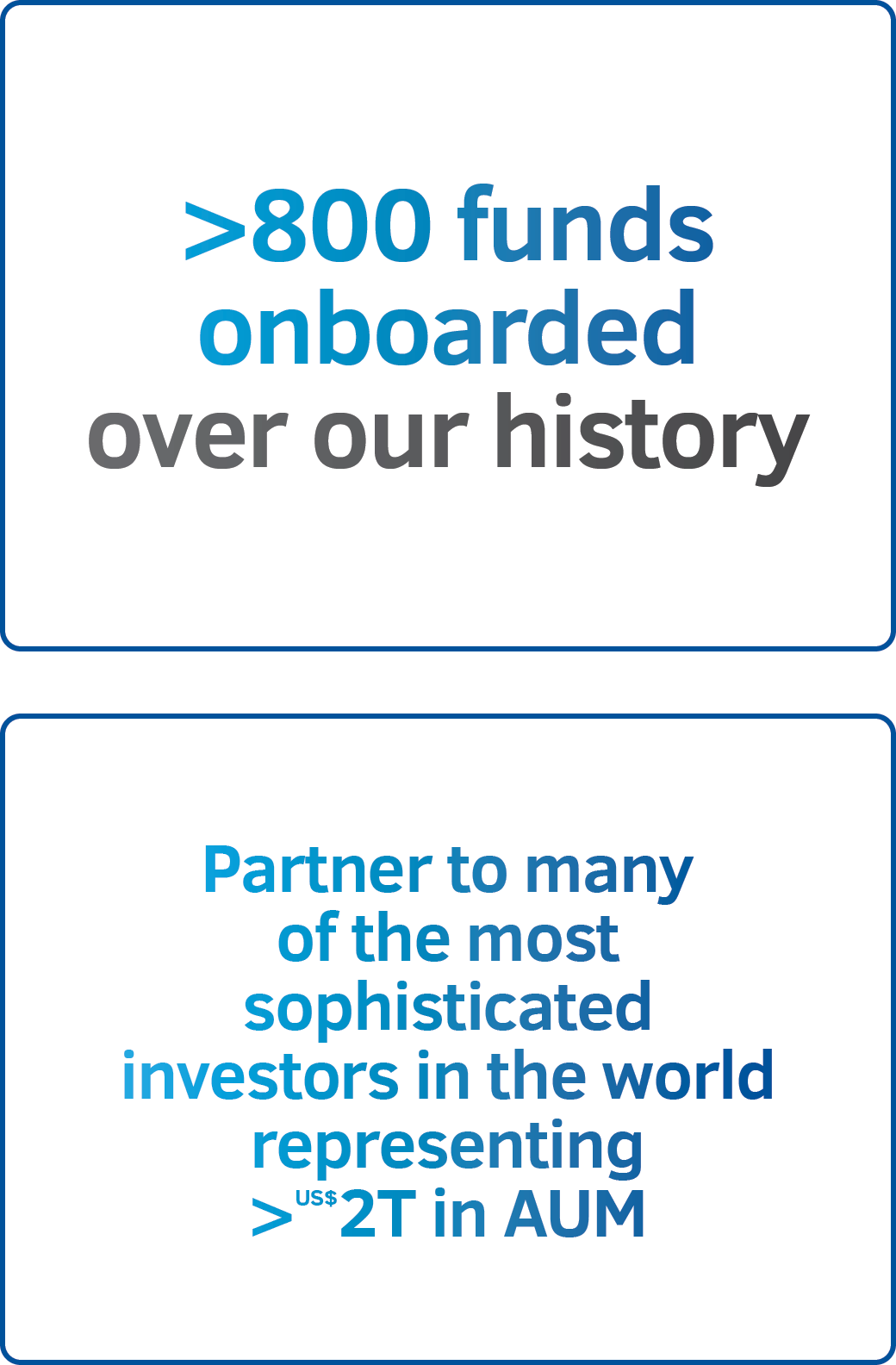

With 25 years of experience and over US$96 billion in assets on the Innocap platform, we now support more than 40 of the world’s most sophisticated allocators who benefit from our expertise, independence, and purpose-built technology.

Management team

Our leaders spent years mastering the complexities of the alternative investments business before developing our fully outsourced Dedicated Managed Account (“DMA”) model. We put this expertise to work to help clients leverage the benefits of a DMA structure. Years of hands-on experience in launching and operating successful DMAs have put us in a unique position to provide solutions tailored to your specific needs.

Chief Technology Officer

As Chief Technology Officer, Sudhanshu leads the firm’s global technology strategy with a focus on innovation, operational resilience, and client-centric digital transformation. He leads a transformative agenda as CTO, focused on modernizing the firm’s technology landscape while aligning it with business growth and operational resilience. Sudhanshu’s vision is rooted in agility and long-term scalability, ensuring that Innocap’s technology backbone is built to support growth, regulatory readiness, and differentiated service in a rapidly evolving financial ecosystem. At Innocap, he is driving a four-pillar strategy that emphasizes data quality, AI and cloud-native innovation, seamless client experiences, and a unified “Process + Tech + People” approach to organizational design.

With over 25 years of experience in capital markets and asset management technology—including senior roles at BMO Financial Group, Bank of America Merrill Lynch, and Algorithmics—Sudhanshu brings deep expertise in building scalable, secure, and data-driven platforms. Sudhanshu holds a bachelor’s degree in Electronics Engineering from A.M. University and a Master’s in Finance (MBA) from T.A.P. Management Institute.

Global Head of Sustainability & Impact Solutions

As Global Head of Sustainability & Impact Solutions, Caroline is responsible for Innocap’s ESG and impact business offering. She leads and develops strategic initiatives targeted to assist Innocap’s clients to invest constructive capital in order to generate growth while contributing to a more sustainable world. Caroline strives to have a meaningful impact on asset owners and asset managers as well as on all stakeholders of the ecosystem.

Caroline was previously Managing Director, Investor Relations and Business Development at Innocap. In that role, she developed powerful partnerships with Innocap’s institutional clients, lead for two years Innocap’s business development efforts in Europe and in the US and was the instigator for our ESG and Impact Solutions product offering. Caroline has over 13 years of experience working in the finance industry. Caroline began her career at Innocap as legal counsel where she helped design and build dedicated managed account platforms for sophisticated investors around the world. She received her Bachelor of Laws from the Sherbrooke University, she holds a Master’s degree in International Trade Law (LL.M.) from Cape Town University (South Africa) as well as the Chartered Alternative Investment Analyst (CAIA) and Sustainable Investment Professional Certification from Concordia University.

Chief Investment Officer

As Chief Investment Officer, Hugues is responsible for supporting clients with the investment decision process and helping allocators build optimal portfolios. He leads the effort to provide clients with actionable information and insightful transparency by turning analytics into a comprehensive and clear story for better investment decisions. As CIO, Hugues acts as a partner and subject matter expert on portfolio construction, optimization and portfolio risk management. Hugues also leads the implementation and management of investment solutions, such as treasury management, currency hedging and overlay strategies.

Hugues was previously Innocap’s Chief Investment & Risk Officer responsible for the data management, quantitative risk modelling, daily investment compliance monitoring and portfolio oversights. Hugues was a leader in the development of Innocap’s portfolio analytic capabilities and was responsible for delivering impactful analysis and visualization to enhance clients’ understanding of the underlying investment risk profile. Prior to joining Innocap, Hugues was a Managing Director and Head of Internal Absolute Return at PSP Investments in Montreal (2004-2016). During that period, he was also part of PSP’s Public Markets Investment Committee and responsible for managing the Public Markets overlay portfolio. Prior to PSP, Hugues gained valuable experience as a Strategist at Bear Stearns International in London, at CN Investment as a Fixed Income portfolio manager and at National Bank of Canada, in their Treasury department. Hugues holds a bachelor’s degree in Actuarial Sciences and a Master’s in Finance (M.Sc) from Laval University as well as a CFA designation.

Global Head of Structuring

As Global Head of Structuring, Aseem is responsible for overseeing all structuring matters related to our Dedicated Managed Account platform. In this capacity, he leads the team advising institutional asset managers and asset owners on a full range of dedicated managed accounts considerations, including the drafting and negotiation of platform related agreements and counterparty trading documentation.

Prior to joining Innocap, Aseem served as Senior Legal Counsel for BNP Paribas Asset Management, providing guidance on a full range of U.S. legal and regulatory issues. His practice focused primarily on product structuring and client onboarding concerns relating to BNP Paribas’ offering of private and public funds, managed accounts and structured products. Aseem previously served as Legal Counsel for Man Group plc, a U.K. based asset manager, where he provided legal support to Man’s alternative investment business, including Man’s managed account and seeding platforms.

Aseem began his legal career as an Associate in the Investment Management group at Schulte Roth & Zabel LLP, representing clients in connection with the formation and maintenance of hedge funds, funds of hedge funds and investment advisory businesses. Aseem received his B.S. in Industrial Engineering from Rutgers, The State University of New Jersey and his J.D. from New York Law School.

President

As President, Josh is responsible for Dedicated Managed Account platform operations and onboarding, product development, business development, marketing, client coverage and ESG and impact solutions. Josh focuses on continuing to evolve and enhance our industry-leading offering and to deliver an exceptional client experience enabling Innocap to transform the industry.

Josh was previously Head of HedgeMark and was responsible for overall management of the HedgeMark business. He was responsible for strategically developing the HedgeMark DMA platform and helped build it from an idea into the largest DMA platform in the industry. Josh has more than 21 years of experience in the hedge fund industry and 18 years of managed account experience. Prior to joining HedgeMark, Josh spent 8 years at Deutsche Bank serving in various senior roles including Head of Managed Account Platform Operations for Deutsche Bank’s X-Markets Hedge Fund Platform in the U.S. and Chief Administrative Officer of DB Advisors Hedge Fund Group. He began his career as an associate in the Investment Management Group of New York law firm, Schulte Roth & Zabel LLP. Josh has authored numerous articles on the subject of dedicated managed accounts and has been a featured speaker at many managed account industry events. He is the Co-Founder and Co-President of Trial Blazers for Kids and a board member of Cannonball Kids cancer, both of which are foundations focused on pediatric cancer research. Josh received a J.D., cum laude, from the University of Pennsylvania Law School and a BA, summa cum laude, from Rutgers College.

Chief People Officer

As Chief People Officer, Afroditi is responsible for the talent, culture and compensation structures of the firm. She leads all initiatives focused on talent acquisition and management, compensation as well as organizational culture, equity, diversity and inclusion. As CPO, Afroditi strives to build a work environment that will offer employees fulfilling careers and will allow our workforce to be renowned as the best in the industry.

Afroditi was previously Innocap’s Chief Compliance Officer. In that role, she built a robust compliance environment that met the strict and complex requirements of the multiple jurisdictions in which Innocap is registered. She developed an in-depth understanding of our business and its people, which will be a crucial asset in her new role as CPO. Afroditi has over 15 years of experience working in the finance industry, having served as senior legal advisor for National Bank of Canada and its internal portfolio manager. She advised on fund and corporate structuring, private and public investment fund regulatory matters, mergers and acquisitions as well as the integration of acquired businesses. She also acted as Senior Compliance Officer and was registered with FINRA as a Supervisor for a New-York based broker-dealer. Before entering the finance industry, Afroditi was a lawyer at Norton Rose Fulbright, working in Mergers & Acquisitions and Securities Law. She received her Bachelor of Laws with distinction from the Université de Montréal.

Chief Operating Officer

As Chief Operating Officer, Andrew is responsible for overseeing Innocap’s investment, risk analytics, data management, technology and transformation groups. Andrew is focused on ensuring we offer the industry’s most complete managed account platform and risk solutions. Andrew concentrates on the company’s use of technology, data, risk analytics and operational processes to improve internal operations and most importantly, client solutions and the client experience. Andrew reports to François Rivard, CEO.

Andrew has over 30 years of experience in the financial services industry. Prior to joining Innocap, he was the CEO of HedgeMark International. Under Andrew’s leadership, HedgeMark grew to become the largest managed account platform provider in the industry. Prior to joining HedgeMark, he was a co-founder and President and Chief Operating Officer of Measurisk, a JP Morgan company that was formerly affiliated with The Bear Stearns Companies. While at Measurisk, a provider of sophisticated risk transparency and risk measurement solutions, Andrew oversaw risk reporting for clients representing over $650 billion in assets. Prior to forming Measurisk, he was a Vice President at Bankers Trust in charge of the development of risk and performance reporting systems and prior to that, a senior technology consultant at Andersen Consulting. Andrew received an MBA. in finance and management from Columbia University and a BA in Economics from Lafayette College.

Chief Financial Officer

As Chief Financial Officer, Edmond leads the finance and accounting function of Innocap. He is responsible for corporate financial affairs, budgets and forecasts, and margin expansion activities. Edmond ensures our internal financial process and protocols are institutional-level while focusing on expanding margins for shareholders in the process.

Edmond was previously leading the accounting and finance function at Innocap. He has over 13 years of experience in Finance and Accounting functions in the investment industry. Prior to joining Innocap, he was responsible for investment funds reporting and the accounting of global investments at Manulife Investment Management. He also worked as an auditor in the largest public accounting firm in Quebec. Edmond is an active Chartered Professional Accountant (CPA) in Canada and received his Bachelor of Commerce from John Molson School of Business in Montreal.

Global Chief Compliance Officer

As Global Chief Compliance Officer of Innocap Group, Kelly is responsible for overseeing all compliance and regulatory affairs across the multiple jurisdictions in which Innocap operates.

She joined Innocap in January 2021 as Legal Counsel and Chief Compliance Officer for the firm’s Irish entity, before assuming her global role in 2023. Prior to joining the company, Kelly held senior legal positions at Crossroads Capital Management Limited, KBC Fund Management, Societe Generale Asset Management, and J.P. Morgan, advising on complex regulatory and legal matters. Earlier in her career, Kelly trained and practised as a solicitor at Dillon Eustace LLP, specialising in finance law.

Kelly holds a Bachelor of Laws (Honours) from the University of London and a Masters in International Commercial Law from the University of Kent. She is qualified to practise law in both Ireland and in England and Wales

General Counsel

As General Counsel, Evelyne is responsible for all legal and regulatory matters of Innocap. She oversees the fund structuring, compliance and corporate affairs groups and manages all legal structuring, compliance and corporate aspects of setting up managed accounts. Evelyn also oversees Innocap’s legal, regulatory and corporate matters.

Evelyne was previously Innocap’s General Counsel since 2016, and before that led the legal fund structuring team. She has helped design and build dedicated managed account platforms for sophisticated investors around the world and has negotiated fund agreements for over 15 years. Evelyne has been in the finance industry for 20 years, having previously worked at a large Canadian bank where she was notably in charge of corporate and regulatory matters for several regulated subsidiaries of the bank. She received a Bachelor of Civil Law and a Bachelor of Laws, with distinction, from McGill University.

Global Head of Platform Accounting

As the Global Head of DMA Accounting, Neil is responsible for overseeing the daily accounting functions of our Dedicated Managed Account platform, including the NAV review process, financial reporting, audit engagements and tax reporting. Neil is also responsible for managing relationships with multiple vendors including fund administrators and external accounting firms as well overseeing the implementation of operational policies and procedures.

Neil was previously HedgeMark’s Head of DMA Accounting and Operations. He has more than 26 years of experience in the hedge fund industry and 18 years of managed account experience. Prior to joining HedgeMark, Neil was Chief Financial Officer of DB Advisors Hedge Fund Group responsible for all aspects of accounting, taxation and client reporting for Deutsche Bank’s fiduciary business of domestic and offshore hedge funds, hedge fund of funds and managed accounts with different trading strategies. He began his career in public accounting with Rothstein, Kass & Company and PricewaterhouseCoopers in onshore and offshore hedge fund administration, auditing and taxation. Neil received a BS in Business Administration with a concentration in Accounting from Montclair State University. He is a Certified Public Accountant (CPA) in New York State.

Chief Executive Officer

As Chief Executive Officer, François is responsible for establishing and delivering Innocap’s overall vision, mission and growth strategy. Francois drives Innocap’s vision of enhancing the way value is created for the communities represented by our clients while maintaining our position as the industry-leading technology-enabled Dedicated Managed Account platform. François makes it his goal to ensure all employees and clients are raving fans of Innocap and that our mission to provide institutional allocators with a superior way to structure, access and monitor their investments is delivered seamlessly.

During his 25 years in the investment industry, François has held various senior functions in capital markets, wealth and asset management in Toronto, Montreal and London. Notably, in his role as Head of the Financial Products Group at National Bank of Canada, he was responsible for engineering and distribution of structured derivative-based investments globally. François is the recipient of Bishop’s University Top 10 After 10 award, a standing YPO member (and past chapter board member), and has contributed or been featured in Bloomberg, the Globe and Mail, Derivatives Week, Structured Products Magazine as well as a featured speaker at various conferences in North America, London, Paris, Zurich, Abu Dhabi and Singapore. Since 2014, François has been a board member and active contributor to the CHU Sainte-Justine Foundation, one of the largest sick kids hospitals and research centers in North America. François received a BBA from Bishop’s University and an MBA from HULT Business School in London.

Chief Risk Officer

As Chief Risk Officer, Andrew is responsible for overseeing the firm’s use of risk calculation tools, data and analytics in addition to implementing an integrated data operations strategy. As CRO, Andrew aims to foster a culture of Risk FinTech, creating market leading risk transparency and insight tools for the firm and its clients.

Andrew was previously HedgeMark’s Head of Risk. In that role, he led overall risk product strategy and day to day risk operations. He has more than 15 years of experience in the hedge fund industry. Prior to joining HedgeMark in 2011, Andrew spent 4 years at Measurisk, LLC as a senior risk specialist focused on hedge fund market risk analysis. Early in Andrew’s career, he held various operational risk and anti-money laundering KYC roles at Deutsche Bank AG and Bank of New York. Andrew received a BBA in International Business and Business Management from Loyola University Maryland and is a Chartered Alternative Investment Analyst (CAIA).

Global Head of DMA Platform Management

As Global Head of DMA Platform Management, Danielle is responsible for the onboarding of new clients and funds to the Innocap platform as well as ongoing platform management services and support. She ensures that clients and funds are onboarded effectively and efficiently and that an outstanding implementation experience is delivered to our clients, managers and service providers.

Danielle was previously Vice President of DMA Platform Management and has 18 years of experience in the hedge fund industry. Prior to joining HedgeMark in 2012, she worked at Nighthawk Partners Inc. from 2003 – 2012 where she was Senior Vice President. While at Nighthawk, Danielle was part of a senior management team that raised assets from institutional investors including insurance companies, family offices, pension consultants, funds of hedge funds, and foundations and endowments. She was also responsible for developing and implementing various back-office procedures and functions across the company. Danielle received a B.A. in Economics from Denison University and holds FINRA Series 7 and 63 licenses with HedgeMark Securities LLC.

Global Head of Products and Innovation

As Global Head of Product and Innovation, Terence leads the delivery of solutions and drives execution of strategic initiatives to optimize operational excellence and margin expansion. He is focused on ensuring alignment of product development and product deployment within the business strategy across the value chain. Terence is also CEO of Innocap’s Irish subsidiary.

Terence joined Innocap as CEO of the Irish subsidiary in 2016. During his 20 years in the investment industry, he has held various senior functions in Dublin and London. From 2008 to 2016, he was Chief Financial Officer of Bainbridge Partners LLP, a London-based Investment Manager with oversight of Finance, Operations, IT, Legal and Compliance. Prior to joining Bainbridge, Terence worked as a Controller at Fortress Investment Group, and as Deputy Chief Financial Officer at Leo Fund Managers Ltd both preceded by roles at Citigroup and Goldman Sachs. Terence is a fellow of the Association of Chartered Certified Accountants (“FCCA”) while having also obtained a BA in Business and Languages from Dublin City University in 2001.

Head of Investment

As Head of Investment, Xavier Urli leads the Investment Solution & Portfolio Oversight Group at Innocap, where he oversees the development of customized investment solutions, advanced risk analytics, and institutional-grade oversight across managed account portfolios.

He previously served as CEO of Innocap Global Investment Management Ltd., where he supervised portfolio management, liquidity and hedging frameworks, and the firm’s regulatory and operational strategy. Earlier in his career, Xavier held portfolio management responsibilities at Desjardins Global Asset Management within the structured notes and fund-of-hedge-funds group.

With a master’s degree in physics from Université de Montréal, Xavier brings a strong quantitative foundation to the design of transparent, scalable, and innovative investment architectures. He regularly contributes to industry discussions on dedicated managed account platforms, risk transparency, and solution engineering.

Global Head of Business Development and Client Relationship Management

As the Global Head of Business Development and Relationship Management, Ben is responsible for fostering and developing all client relationships for the firm. In this role, Ben articulates and implements the firm’s strategy to drive growth and position Innocap as the Dedicated Managed Account platform market leader. Ben strives to educate clients on industry trends and product solutions so that they are best positioned to harness the power of Innocap to solve their challenges and optimize their investments.

Ben was previously HedgeMark’s Head of Business Development. He has more than 20 years of experience working with institutional investors in the hedge fund industry. Prior to joining HedgeMark in 2012, he was President of Nighthawk Partners Inc., a third party marketing firm for hedge funds, where he was responsible for sourcing product and leading distribution in North America and Europe. Ben began his career in alternative investments at Asset Alliance Corporation, a hedge fund seeding business and early user of managed accounts. Ben received a BA in Economics from Union College and holds FINRA Series 7, 24 and 63 licenses with HedgeMark Securities LLC.

Global Head of Treasury & Fund Operations

As the Global Head of Fund Operations, Amanda is responsible for overseeing operations of our Dedicated Managed Account platform. Amanda’s mandate is to uphold best practices for hedge fund operations, while increasing efficiencies and expanding client reporting through HM Operations, a proprietary application developed to enhance and automate onboarding, operations and accounting processes for DMAs.

Amanda was previously Chief Operating Officer of HedgeMark. She has 22 years of experience in the hedge fund industry. Prior to joining HedgeMark, Amanda spent 11 years as a trader for an emerging markets hedge fund as well as a credit and equity volatility fund within Deutsche Asset Management. Amanda received a BS from the University of Notre Dame and is a CFA Charterholder.